MI UIA-1020 2011-2024 free printable template

Show details

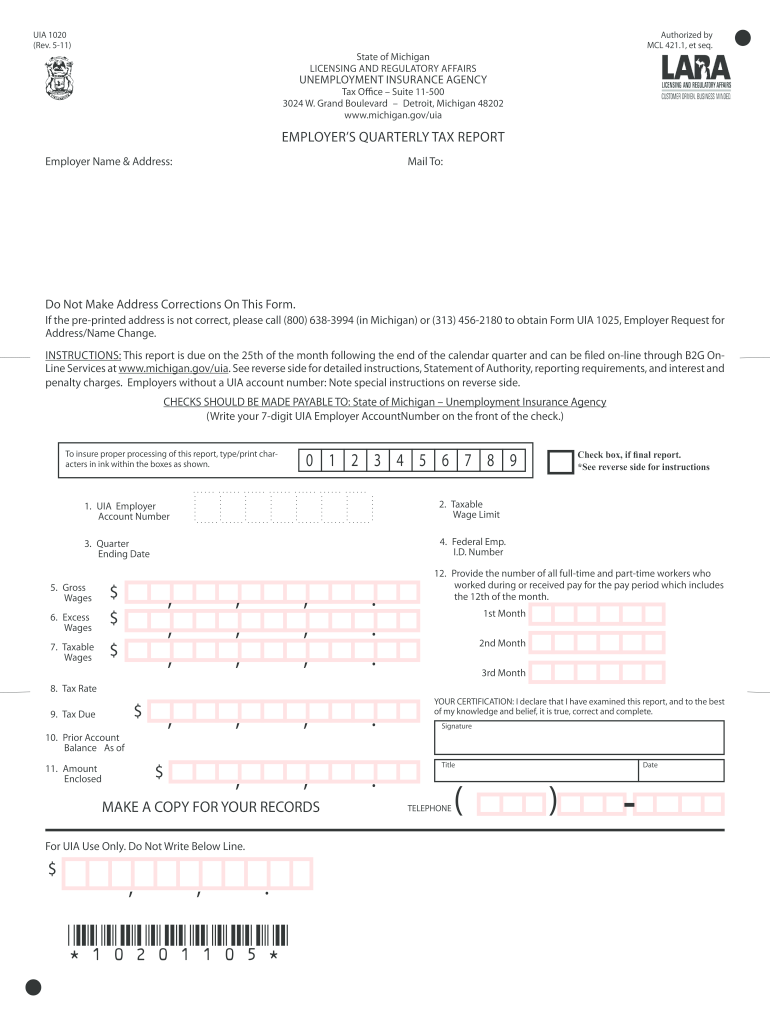

UIA 1020 Rev. 5-11 State of Michigan Authorized by MCL 421. 1 et seq. LICENSING AND REGULATORY AFFAIRS Reset Form UNEMPLOYMENT INSURANCE AGENCY Tax Office Suite 11-500 3024 W. Grand Boulevard Detroit Michigan 48202 www. SPECIAL INSTRUCTIONS FOR NEW EMPLOYERS IF YOU HAVE RECENTLY FILED FORM 518 REGISTRATION FOR MICHIGAN BUSINESS TAXES AND HAVE NOT YET RECEIVED YOUR UIA ACCOUNT NUMBER call Team Support at 313 456-2180 to request your account number. Michigan.gov/uia EMPLOYER S QUARTERLY TAX...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form uia 1733 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form uia 1733 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form uia 1733 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

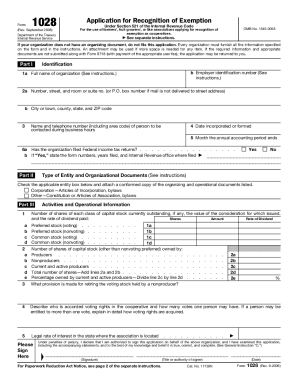

Edit michigan form uia 1028 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out form uia 1733

How to fill out quarterly tax report:

01

Gather all necessary documents such as income statements, expense receipts, and any relevant financial records.

02

Calculate your total income for the quarter and deduct any eligible expenses. Consult with a tax professional if needed.

03

Determine your tax obligations based on the current tax laws and regulations.

04

Fill out the necessary forms, such as Form 941 or Form 1040-ES, providing accurate and complete information.

05

Double-check all the entered information to ensure accuracy and compliance with tax regulations.

06

Submit the completed tax report by the designated deadline, either online or by mail.

07

Keep copies of all submitted documents for your records.

Who needs quarterly tax report:

01

Self-employed individuals who anticipate owing $1,000 or more in annual taxes.

02

Small business owners who have employees and are required to withhold and pay payroll taxes.

03

Freelancers and independent contractors with a significant amount of income not subject to regular tax withholding.

04

Partners in a partnership or members of an LLC that elects to be taxed as a partnership.

05

S corporations, which must complete and file Form 1120-S and Schedule K-1 for each shareholder.

06

Individuals with significant sources of income from investments, rental properties, or other taxable sources outside of regular employment.

It is essential to consult with a tax professional or the appropriate tax authority to determine if you need to file quarterly tax reports and to ensure compliance with applicable tax laws in your jurisdiction.

Fill form uia pdf : Try Risk Free

People Also Ask about form uia 1733

Can I do my own quarterly taxes?

What tax forms are due quarterly?

Is there a form for quarterly taxes?

How do I get a copy of my IRS Form 941?

How do I get a copy of my 941 quarterly report?

What is a 941 quarterly report?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is quarterly tax report?

A quarterly tax report is a report that summarizes the total amount of taxes paid during a three-month period. This report typically includes information about the total amount of taxes due, taxes paid, the time frame in which the taxes were paid, and other details about the taxes paid during the period. It is used to ensure that businesses and individuals are meeting their tax filing obligations in a timely manner.

What information must be reported on quarterly tax report?

Quarterly tax reports must include detailed information about income, deductions, and other financial-related activities in the reporting period. This includes gross income, taxable income, income tax withheld, contributions to tax-deferred accounts, and other deductions or credits claimed. In addition, quarterly tax reports must also include information about any estimated taxes paid, as well as any other taxes due.

Who is required to file quarterly tax report?

There are various entities and individuals who may be required to file quarterly tax reports. Some examples include:

1. Self-employed individuals: If you are self-employed and expect to owe $1,000 or more in taxes for the year, you are generally required to make quarterly estimated tax payments.

2. Freelancers or independent contractors: Similar to self-employed individuals, freelancers or independent contractors who anticipate owing $1,000 or more in taxes usually need to file quarterly tax reports.

3. Business owners: Partnerships, corporations, and S corporations often pay quarterly estimated taxes.

4. High-wage earners without sufficient withholding: If you have a significant amount of income not subject to withholding, such as investment income or rental income, you might need to make quarterly estimated tax payments.

It is important to note that tax requirements vary depending on the jurisdiction and individual circumstances, so it is advisable to consult with a tax professional or the relevant tax authority to determine your specific obligations.

What is the purpose of quarterly tax report?

The purpose of a quarterly tax report is to provide information about an individual or entity's tax liabilities and payments for a specific quarter of the year. It allows taxpayers to report their income, deductions, credits, and any taxes withheld from their earnings. The report helps keep track of tax obligations and ensures compliance with tax laws. Additionally, the information in the quarterly tax report can be used by tax authorities to calculate and assess the appropriate amount of taxes owed and to identify any discrepancies or potential issues that may require further scrutiny or investigation.

When is the deadline to file quarterly tax report in 2023?

The deadline to file quarterly tax reports in 2023 would depend on the tax jurisdiction you are referring to. In the United States, for example, the deadlines for quarterly tax reports for individuals are usually April 15th, June 15th, September 15th, and January 15th (of the following year). However, it is always recommended to consult the specific tax authority or a tax professional to obtain the most accurate and up-to-date information regarding deadlines and requirements.

What is the penalty for the late filing of quarterly tax report?

The penalty for the late filing of a quarterly tax report can vary depending on the jurisdiction and the specific regulations in place. In many countries, late filing of tax reports can result in financial penalties, which may be a fixed fee or a percentage of the tax owed. Penalties can accumulate if the report continues to be filed late, and additional interests may be added to the amount owed. It is important to consult the specific tax laws and regulations applicable to your jurisdiction for accurate and up-to-date information on penalties for late filing.

How to fill out quarterly tax report?

Filling out a quarterly tax report typically involves the following steps:

1. Gather necessary information: Collect all the relevant financial records, including income, expenses, and any applicable tax forms such as 1099s.

2. Determine the correct form to use: Quarterly tax reports are typically filed using Form 1040-ES for individuals or Form 941 for employers. Determine which form is appropriate for your situation.

3. Calculate estimated tax liability: Use the information gathered in step 1 to calculate your estimated tax liability for the quarter. This includes calculating both your income tax and self-employment tax (if applicable).

4. Complete the necessary sections of the form: Fill out the required sections of the chosen form, including personal information, income information, deductions, and credits. Follow the instructions provided with the form to ensure accurate reporting.

5. Pay estimated taxes: If you owe taxes for the quarter, make a payment with your completed form. The payment can be made online or through traditional methods like sending a check or money order.

6. Retain copies and recordkeeping: Keep a copy of the filled-out form and any accompanying documents for your records. It's important to maintain good recordkeeping practices for future reference or potential audits.

7. Repeat for each quarterly period: Quarterly tax reporting should be done for each quarter, typically due on April 15, June 15, September 15, and January 15 of the following year.

It's recommended to consult with a tax professional or use tax software to ensure accurate and timely reporting. Tax laws and forms may vary depending on your jurisdiction and situation, so professional guidance can be helpful.

Where do I find form uia 1733?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the michigan form uia 1028 form. Open it immediately and start altering it with sophisticated capabilities.

How do I complete form uia printable online?

Completing and signing report quarterly uia online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit uia 1028 michigan form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your michigan uia 1020 form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your form uia 1733 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Uia Printable is not the form you're looking for?Search for another form here.

Keywords relevant to michigan uia 1733 form

Related to uia 1028 form michigan

If you believe that this page should be taken down, please follow our DMCA take down process

here

.