MI UIA-1020 2011-2026 free printable template

Show details

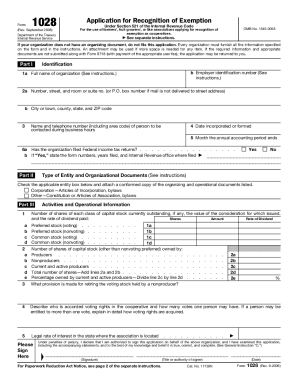

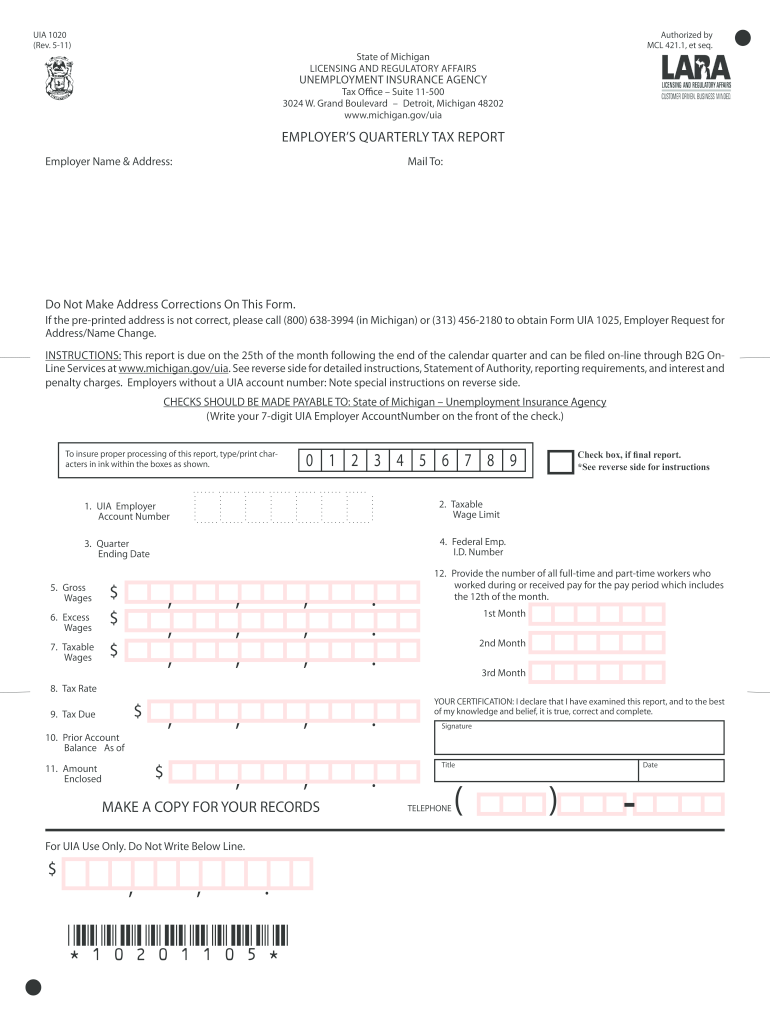

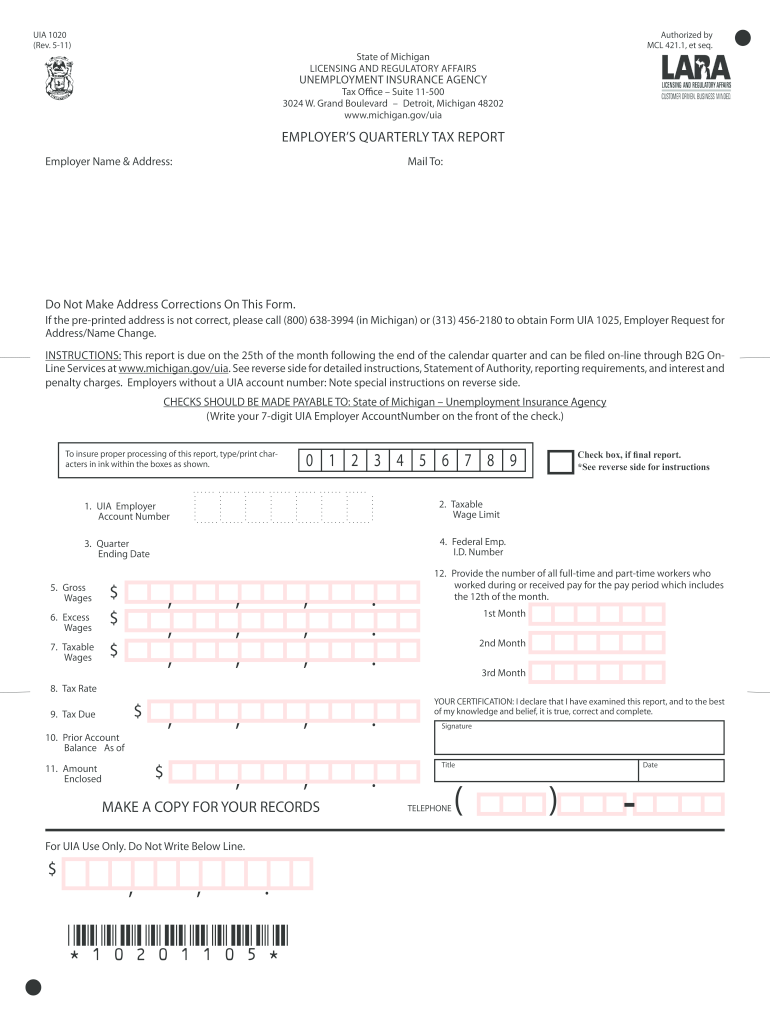

UIA 1020 Rev. 5-11 State of Michigan Authorized by MCL 421. 1 et seq. LICENSING AND REGULATORY AFFAIRS Reset Form UNEMPLOYMENT INSURANCE AGENCY Tax Office Suite 11-500 3024 W. Grand Boulevard Detroit Michigan 48202 www. SPECIAL INSTRUCTIONS FOR NEW EMPLOYERS IF YOU HAVE RECENTLY FILED FORM 518 REGISTRATION FOR MICHIGAN BUSINESS TAXES AND HAVE NOT YET RECEIVED YOUR UIA ACCOUNT NUMBER call Team Support at 313 456-2180 to request your account number. Michigan.gov/uia EMPLOYER S QUARTERLY TAX...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign uia 1028 form

Edit your quarterly tax report pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form uia 1020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uia 1028 form michigan online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form uia 4101. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uia 4101 form

How to fill out MI UIA-1020

01

Begin by downloading the MI UIA-1020 form from the official website.

02

Fill out your personal information in the designated fields, including your name, address, and contact details.

03

Provide your Social Security number and any other required identification.

04

Indicate your employment history, listing your previous employers and the dates of employment.

05

Detail the reason for filing the claim, including any relevant incident information.

06

Ensure that you have signed and dated the form before submission.

07

Submit the completed form by mail or online as instructed.

Who needs MI UIA-1020?

01

Individuals who are unemployed and seeking benefits due to job loss or reduction in hours.

02

Employees who have been laid off or separated from their employer.

03

Workers who need to file for unemployment insurance in Michigan.

Fill

mi uia 1028

: Try Risk Free

People Also Ask about 1020 form

Can I do my own quarterly taxes?

You can submit your quarterly payments online through the Electronic Federal Tax Payment System or pay them using paper forms available from the IRS.

What tax forms are due quarterly?

You must file both a Quarterly Contribution Return and Report of Wages (DE 9) and the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) each quarter.

Is there a form for quarterly taxes?

Use Form 1040-ES to figure and pay your estimated tax.

How do I get a copy of my IRS Form 941?

Call 800-829-3676.

How do I get a copy of my 941 quarterly report?

Call 800-829-3676.

What is a 941 quarterly report?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find uia form 1028?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the uia employer account number. Open it immediately and start altering it with sophisticated capabilities.

How do I complete uia 1028 form online?

Completing and signing form uia 1028 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit form 1028 michigan online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your uia form 1027 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is MI UIA-1020?

MI UIA-1020 is a form used by employers in Michigan to report unemployment insurance tax information and employee wages to the Michigan Unemployment Insurance Agency (UIA).

Who is required to file MI UIA-1020?

Employers in Michigan who are subject to unemployment insurance laws are required to file MI UIA-1020. This includes most businesses that have employees working in Michigan.

How to fill out MI UIA-1020?

To fill out MI UIA-1020, employers need to provide their business identification information, report total wages paid to employees, calculate the unemployment tax owed, and submit the form by the due date.

What is the purpose of MI UIA-1020?

The purpose of MI UIA-1020 is to collect necessary data from employers to ensure accurate reporting of employee wages and calculation of unemployment insurance taxes to support the state's unemployment benefit fund.

What information must be reported on MI UIA-1020?

Employers must report information such as the business name, address, federal employer identification number (FEIN), total wages paid, number of employees, and the amount of unemployment tax owed.

Fill out your MI UIA-1020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Uia Forms is not the form you're looking for?Search for another form here.

Keywords relevant to form 1020 pdf

Related to form 1733 uia

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.